UK 2014 Budget - Vehicle Excise Duty

Posted: 19 Mar 2014 09:57 pm

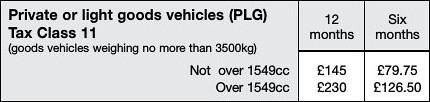

I'll find the VED rates tables when they've published new ones. RPI is about 3%, so expect another fiver or tenner on the annual bill.The UK Budget 2014 document wrote:2.152 Vehicle Excise Duty (VED) rates and bands – VED rates for cars, motorcycles and the main rates for vans will increase by RPI from 1 April 2014. (Finance Bill 2014)

2.153 VED: classic vehicle exemption – The government will introduce a rolling 40 year VED exemption for classic vehicles from 1 April 2014. (Finance Bill 2014 and future Finance Bills) (39)

2.154 VED administrative simplification – As announced at Autumn Statement 2013, the government will introduce legislation to reduce tax administration costs and burdens by making the following changes with effect from 1 October 2014:

- motorists will be able to pay their VED by direct debit annually, biannually or monthly, should they wish to do so. A 5% surcharge will apply to biannual and monthly payments (Finance Bill 2014) (c)

- a paper tax disc will no longer be issued and required to be displayed on a vehicle windscreen (Finance Bill 2014)